- Development of the first axillary in vitro shoot multiplication protocol for coconut palms. Cloning the tree of life, really fast.

- Frequent germplasm exchanges drive the high genetic diversity of Chinese-cultivated common apricot germplasm. Looking forward to the same being said about coconut.

- Crop diversity effects on temporal agricultural production stability across European regions. The effects are good.

- Are agricultural sustainability and resilience complementary notions? Evidence from the North European agriculture. They are indeed, but what about stability though?

- Seasonal variability of women’s dietary diversity and food provisioning: a cohort study in rural Burkina Faso. Do Europe now.

- The “Sweet Spot” in the Middle: Why Do Mid-Scale Farms Adopt Diversification Practices at Higher Rates? Spoiler alert: it’s got less to do with farm size than with access to resources and markets. At least for Californian lettuce farmers.

- Politics of seeds in Ethiopia’s agricultural transformation: pathways to seed system development. The Ethiopian seed system needs diversification just as much as Californian lettuce farmers.

- Biocultural Diversity for Food System Transformation Under Global Environmental Change. What we all need is biocultural diversity.

- Harnessing the diversity of small-scale actors is key to the future of aquatic food systems. Yes, all of us, whether in mountains or by the sea.

- Combatting global grassland degradation. It may be stretching a point, but biocultural diversity may also be a useful lens through which to look at grassland restoration and sustainable management. But then I would say that.

- Supporting wild pollinators in agricultural landscapes through targeted legume mixtures. Yeah, let’s not forget the pollinators while we’re at it.

Brainfood: Commons edition

- Seeds of resilience: the contribution of commons-based plant breeding and seed production to the social-ecological resilience of the agricultural sector. A seed production commons is good for agroecology and resilience. At least in the German-speaking vegetable sector. Yeah, but give them an inch…

- Crop Diversity Management System Commons: Revisiting the Role of Genebanks in the Network of Crop Diversity Actors. …and they’ll take a mile.

- Changing patterns in genebank acquisitions of crop genetic materials: An analysis of global policy drivers and potential consequences. Maybe it would be good if they took that mile.

- Seeds as natural capital. This is the mile we’re talking about. It’s worth fighting for.

- A Critical Review of the Current Global Ex Situ Conservation System for Plant Agrobiodiversity. II. Strengths and Weaknesses of the Current System and Recommendations for Its Improvement. It has become a really complicated mile.

- Uses and benefits of digital sequence information from plant genetic resources: Lessons learnt from botanical collections. And this makes it even more complicated.

- Impact of climate change on biodiversity and food security: a global perspective—a review article. Yeah, but look what happens if we don’t do something.

- Agrobiodiversity Index scores show agrobiodiversity is underutilized in national food systems. And we’re certainly not doing enough.

- Endangered Wild Crop Relatives of the Fertile Crescent. See what I mean?

- Crop diversity is associated with higher child diet diversity in Ethiopia, particularly among low-income households, but not in Vietnam. Sure, I know it’s complicated…

- Insights into the genetic basis of the pre-breeding potato clones developed at the Julius Kühn Institute for high and durable late blight resistance. …but just look what’s possible with a little effort…

- Spatiotemporal seed transfer zones as an efficient restoration strategy in response to climate change. …and a little thinking. Well, a lot of effort and thinking.

- Current Advancements and Limitations of Gene Editing in Orphan Crops. And on top of all that, we have this to look forward to.

- Inactivation of the germacrene A synthase genes by CRISPR/Cas9 eliminates the biosynthesis of sesquiterpene lactones in Cichorium intybus L. Well actually it’s already here.

- Living standards shape individual attitudes on genetically modified food around the world. Maybe if they were in a commons? Wait, isn’t this where we started?

- Waive CRISPR patents to meet food needs in low-income countries. It does look like it.

Nibbles: Ancient Levant, Guinness cherry, NBPGR, Maize in Africa

- More than milk and honey.

- A very large cherry.

- A very large genebank.

- Let them eat sorghum, Zambian president says.

- That’s not an option for the Hopi.

Smallholder access to seeds in Africa benchmarked

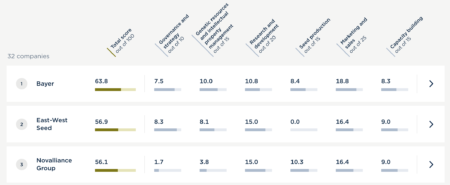

You’ll remember that the good people at Access to Seeds Index rate seed companies on how and to what extent they make their products available to smallholder farmer in developing countries. Today they launched the results for 32 companies working in Western and Central Africa. Here are the key findings (I’m quoting):

- Seed companies are active in almost all index countries across Sub-Saharan Africa and South and South-east Asia.

- Many companies are providing more diverse portfolios for vegetables and field crops but need to offer more pulses to help tackle malnutrition.

- Leading seed companies are offering extension services in more countries.

- Companies are still only concentrating their investments in infrastructure in a few countries.

But you want to know who did well in the rankings, right? Ok, here’s the Top 3.

Well done, Bayer, East-West and Novalliance.

Nibbles: Luxury brands, Food companies, TV and diets, Saving seeds, IUCN Green Status, 0 Hunger Pledge, Zizania

- Luxury brands discover biodiversity: “There is no champagne without grapes, no ready-to-wear without silk and cotton, no perfume without flowers…”

- What about global food and agriculture companies though? Let’s find out, shall we?

- TV can help where companies won’t.

- Of course, you can set up your own company, as these Tunisian women did.

- Imagine a company helping to move a species to “green status.” Imagine.

- They could sign the Zero Hunger Pledge for the Private Sector while they’re at it.

- But meanwhile, on Ojibwe land…