- Cuba recognizes traditional medicine.

- Your grandma’s cooking was not that great.

- Using genetics to guide teak restoration.

- Botany dying in the US.

- Brazil sets up lots of community seedbanks.

- Aren’t seeds just great?

- The 1000 beer genomes project is as great as it sounds.

- Palestinians freekeh out.

- Interview with Cary Fowler: about Svalbard, and much more.

- Mama boga in trouble. Bastards.

- Nature calls for crop improvement.

Brainfood: Resilience and diversity, Cold tolerant rice, Old baobabs, VIR, Local adaptation, Prunus phylogeny, Bactris mating, Land use change, Wheat landraces, Amazonian agrobiodiversity

- Does Plant Species Richness Guarantee the Resilience of Local Medical Systems? A Perspective from Utilitarian Redundancy. It depends on how knowledge is distributed.

- COLD1 Confers Chilling Tolerance in Rice. From a wild relative.

- Searching for the Oldest Baobab of Madagascar: Radiocarbon Investigation of Large Adansonia rubrostipa Trees. 1,600 years seems to be the record.

- Genetic resources of cultivated plants as the basis for Russia’s food and environmental security. VIR needs Roubles 425 million a year ($14.3 million).

- Using archaeogenomic and computational approaches to unravel the history of local adaptation in crops. Models say that adaptation to higher latitudes was rapid, simple (few genes) and unstable.

- Combining conservative and variable markers to infer the evolutionary history of Prunus subgen. Amygdalus s.l. under domestication. Almonds and peaches were domesticated on either side of the Central Asian Massif from different sections of the genus that had been there for 5 million years.

- Conservation implications of the mating system of the Pampa Hermosa landrace of peach palm analyzed with microsatellite markers. Bactris effective population size in genebanks is too small.

- Global effects of land use on local terrestrial biodiversity. Within-sample total terrestrial species diversity down by 13.6% globally. About the same for crop wild relatives?

- Exploiting genetic diversity from landraces in wheat breeding for adaptation to climate change. It would be a good idea.

- Household Agrobiodiversity Management on Amazonian Dark Earths, Oxisols, and Floodplain Soils on the Lower Madeira River, Brazil. Age of household head, size of household and area of land under cultivation predict amount of agricultural biodiversity managed.

Nibbles: Rabbit origins, New beans and rice, New maize, Fermentation, Grape bugs, Kenya supergoats, Peruvian edible insects, Betelmania, Sustainable cacao, Making cider, Land rights, Kew funding, Avocado origins, German genebank, Oman roadshow, Chinese agriculture then and now, Underground farm, Irish potatoes, Lactase history, Nutrition report, Breeding wheat, Pulse year, Perennial cereals, Shaker agriculture, Food conference, Lupin breeding, Tanzanian ag landscapes, Coffee film, American food, Breakfast around the world, Indian wild figs, Baobab, Fragmentation, History of breeding, MARDI fruits, IARI head, Wild pig genome, Breed typology

Yeah, I know, been slacking with the blogging again of late. Lots of travel. Will try to post about it a bit now I’m back. Here’s the usual back-in-the-office game of catch-up.

- We start with something topical for Easter. The origin of the bunny: it’s not the genes, it’s the gene control control.

- CIAT’s heat-resistant beans are all over the internet. IRRI’s new rices, not so much.

- I hope they get names like Bill Tracy’s new open-pollinated maize variety.

- Bugs come in communities, and they do best when they stay that way.

- Even on grapes.

- Gotta get me one of these Kenyan supergoats.

- Are bugs next on Peru’s gastronomia menu? Probably not.

- Ban the betel!

- More on that we-need-GMO-to-save-chocolate thing. Because this?

- Some like it hard.

- Three steps to secure land rights.

- “If the seeds are never grown, they will fizzle out. Who is going to sow them and harvest them to keep them fresh?”

- The avocado shouldn’t be here. So sue me.

- The Ghana News Agency (and nobody else) says there’s a new genebank in Berlin.

- Oman’s biodiversity (including agricultural) goes on the road.

- Chinese agriculture goes sustainable. Well, in theory. Including for buckwheat, presumably.

- Maybe you can work out what this early Chinese flour was actually of: millet, barley and/or wheat?

- Meanwhile, in Japan, the opposite of sustainable farming beneath a Tokyo street.

- The Irish and the potato: in need of a reset?

- Want to develop? Learn to metabolize lactose.

- Ten research questions on nutrition.

- Well at least this gluten nonsense 1 is helping bring back some funky grains. And is spurring breeders. Who should perhaps be focusing on more important problems?

- Pulses will get their 15 minutes in 2016.

- The Land Institute is still at it, and still getting press.

- The United Society of Believers in Christ’s Second Appearing established one of the earliest seed companies in the US.

- No, getting to the bottom of food ain’t easy.

- Lupins better than soya in the UK, because breeding.

- A Tanzanian mash-up: Farmers need the landscape. I’m not kidding. And yet…

- There’s a film about coffee called “A film about coffee.”

- “In the future, the American dream of big cars and burgers will need to be adjusted to more active transport and sustainable, healthy eating. Better is the new bigger. The world needs a new diet. And it is waiting for the US to take the lead.” Good luck with that.

- Maybe start with breakfast?

- Indians need their wild figs.

- As much a African need baobabs, probably.

- A fragmented forest is no forest at all. Well, almost.

- BHL does domestication. As ever, great pix too.

- Malaysia protects its fruits.

- Who will head the Indian Agricultural Research Institute?

- The pygmy hog has been sequenced.

- A typology of livestock breeds.

The cost-benefit of Australian genebanks

We’ve now received a copy of the 2007 report to the Steering Committee of Australia’s National Genetic Resource Centre entitled “Benefit-cost analysis of the proposed National Genetic Resources Centre,” as trailed in an earlier post. That’s the one that was said to posit a return on investment of 119:1 for the Australian pastures genebank. It makes for interesting reading, and we’ll try to summarize the main points here.

First, some clarifications, though. It in fact does not posit a return on investment (ROI) of 119:1 for the Australian pastures genebank. Sorry we gave that impression earlier. That is the ROI for the whole Australian National Genetic Resources Centre (NGRC), of which the pastures collection is just a part. Let me back up a bit. The Primary Industries Ministerial Council of Australia agreed in 2006 that the 5 existing, separate state-run genebanks (managing something like 180,000 accessions in total) should be amalgamated into a single (but actually two-node), national facility.

This was seen as an important pre-requisite for meeting Australia’s obligations under the International Treaty of Plant Genetic Resources for Food and Agriculture. As part of that process, The Allen Consulting Group was asked to consider the situation of no agricultural plant germplasm being conserved in Australia, work out how much the NGRC would be worth to Australia if that counterfactual were not in fact true, and compare that to the projected cost of setting up and running the NGRC.

The cost side of things was not that difficult to work out. It was estimated that the 2-node (crops and pastures) NGRC would cost about A$ 590,000 to set up, and A$ 3.5 million a year to run thereafter (compared to A$ 3.705 million a year for the 5-genebank system). Over 30 years, discounted at 6% real (whatever that means), that’s an outlay of A$ 51.7 million.

To get to the value of the system, it was necessary to make some assumptions:

- Continued access to germplasm held in Australia would enable historic trends in the growth of farm productivity to continue.

- Holding no germplasm in Australia would mean growth of productivity due to plant genetic enhancement would continue, but at a slower rate. Productivity gains due to other things would stay the same.

- The share of productivity gains due to plant genetic enhancement varied from 5% (sheep farming) to 30% (field crops).

- The share of productivity gains from plant genetic enhancement due to access to germplasm collections in Australia was 30%.

Put all that into your spreadsheet and you get a total of A$ 5 billion net present value to the productivity of Australian agriculture over the next 30 years. Add another A$ 1.2 billion in assorted benefits not associated with increased productivity (things like water quality, public health etc.), and you get A$ 6.2 billion (that’s an annuity benefit of A$ 364 million), which divided by the 30-year cost gives you that 119:1 ratio.

How confident are The Allen Consulting Group in their results? Well, they identified two key uncertainties: the annual discount rate and the share of genetic gain attributable to access to germplasm in Australia. Tweak the 6% and 30% values of these two things, respectively, and you get a range of productivity benefits over 30 years of A$ 1.2-14.7 billion around the canonical A$ 5 billion.

But when you think about it what the study actually did is work out the return to Australian agriculture of those 180,000 accessions being conserved, somewhere. The material could be held in places other than Australia, after all, and still be available under the International Treaty. Ah, but the study also figured that the cost of servicing demand by Australian breeders would be 20% higher if the average 14,000 yearly seed samples they requested had to come from genebanks outside the country, rather than the NGRC (because of stuff like quarantine etc.). So there were efficiency gains, which were factored into the benefits side of the equation.

So there you have it. Put another way, each accession maintained in the Australian systems will cost the Australian taxpayer A$ 21 a year over the next 30 years, and return A$ 194 a year to the Australian economy. I think: I get confused, but I think that’s right. That sounds pretty good, though I guess one should compare it with other sorts of investments the Australian government could make. Anyway, it seems the powers that be thought it was a bet worth making. And it’s not only Australians that should be grateful for that.

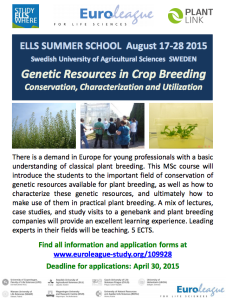

Genetic Resources in Crop Breeding course in the offing

A course on genetic resources for plant breeding is being organized at the Swedish University of Agricultural Sciences (SLU), Alnarp, Sweden. The person responsible is Prof. Rodomiro Ortíz, who has a huge amount of experience in the field, with a wide variety of crops. It’ll be in August, and the deadline for applications is April 30.

A course on genetic resources for plant breeding is being organized at the Swedish University of Agricultural Sciences (SLU), Alnarp, Sweden. The person responsible is Prof. Rodomiro Ortíz, who has a huge amount of experience in the field, with a wide variety of crops. It’ll be in August, and the deadline for applications is April 30.